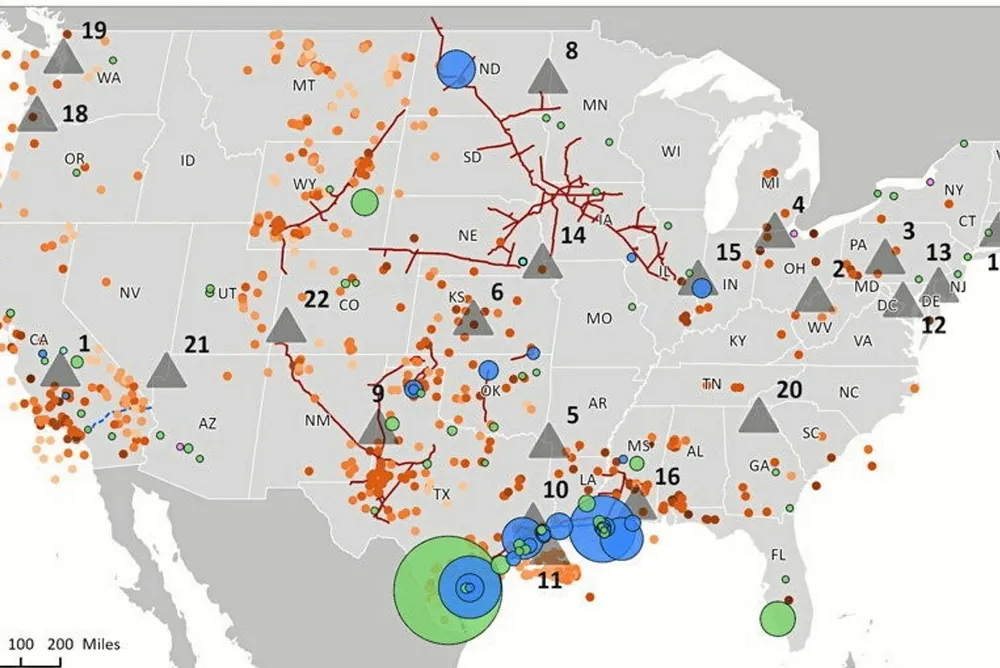

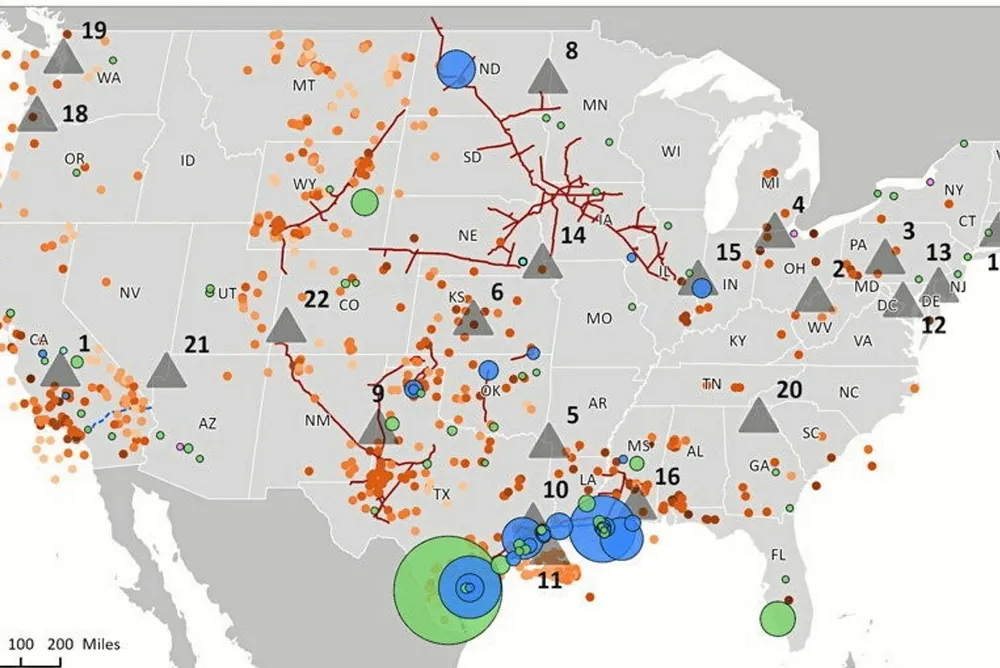

EXCLUSIVE | The top ten US hydrogen hubs most likely to win $7bn of government funding

Geography, rather than suitability, could determine which are selected from a current crop of 22, argues Rystad Energy

Geography, rather than suitability, could determine which are selected from a current crop of 22, argues Rystad Energy