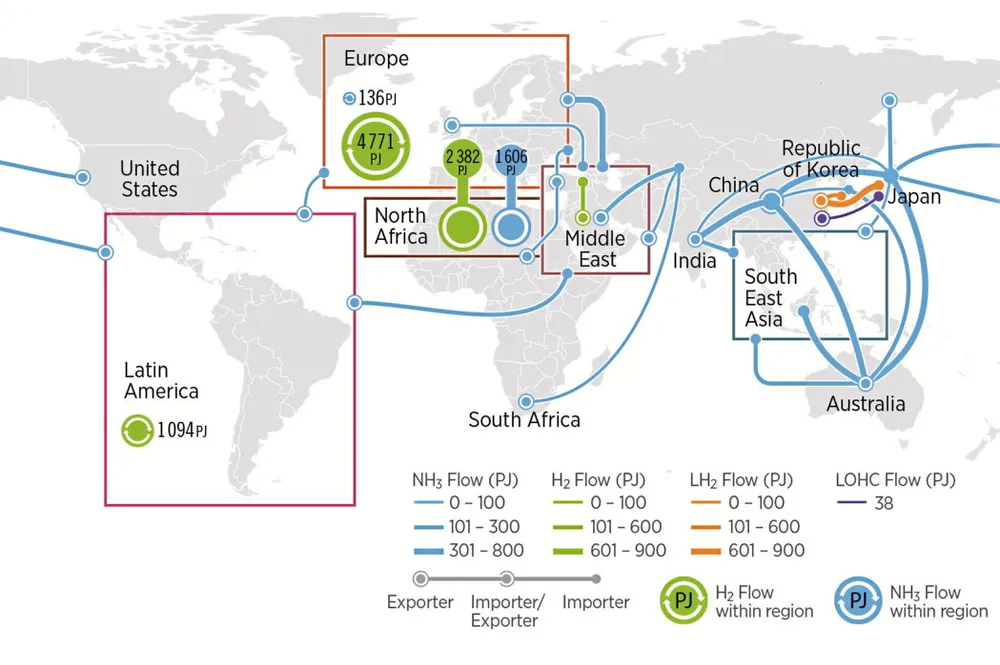

This is what the massive international clean hydrogen trade may look like in 2050: Irena

More than 100 million tonnes of green hydrogen, and 50 million tonnes of blue H2, will be traded internationally each year by mid-century — by pipeline or ammonia ships — according to a new report by the International Renewable Energy Agency