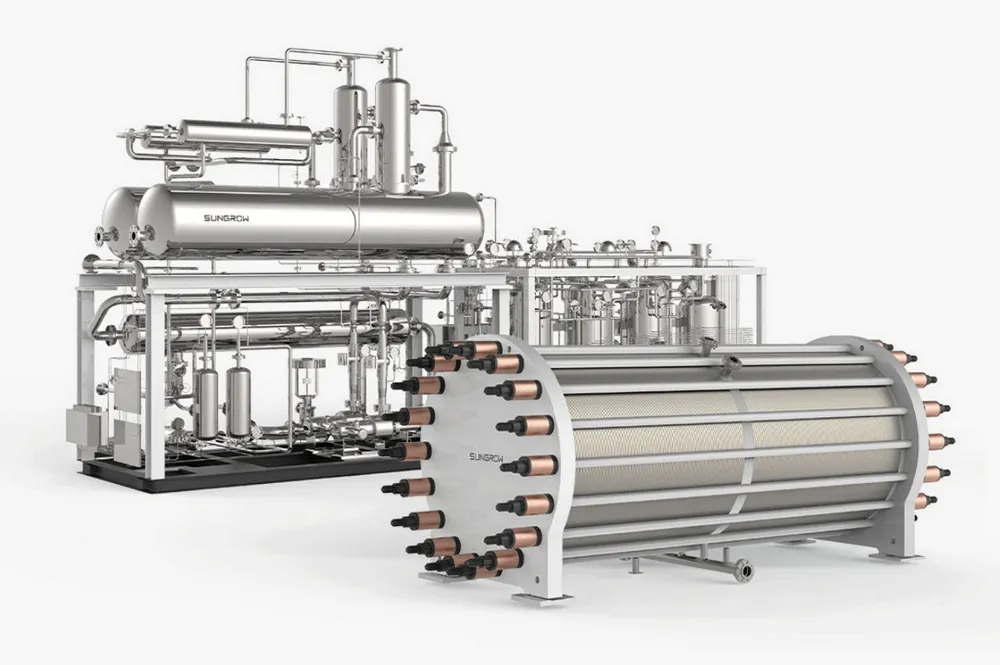

Auction results reveal that Chinese hydrogen electrolysers are two to five times cheaper to buy than Western machines

State-owned China Energy Engineering Corporation publishes details of winning bids at ‘centralised procurement’ tender

State-owned China Energy Engineering Corporation publishes details of winning bids at ‘centralised procurement’ tender