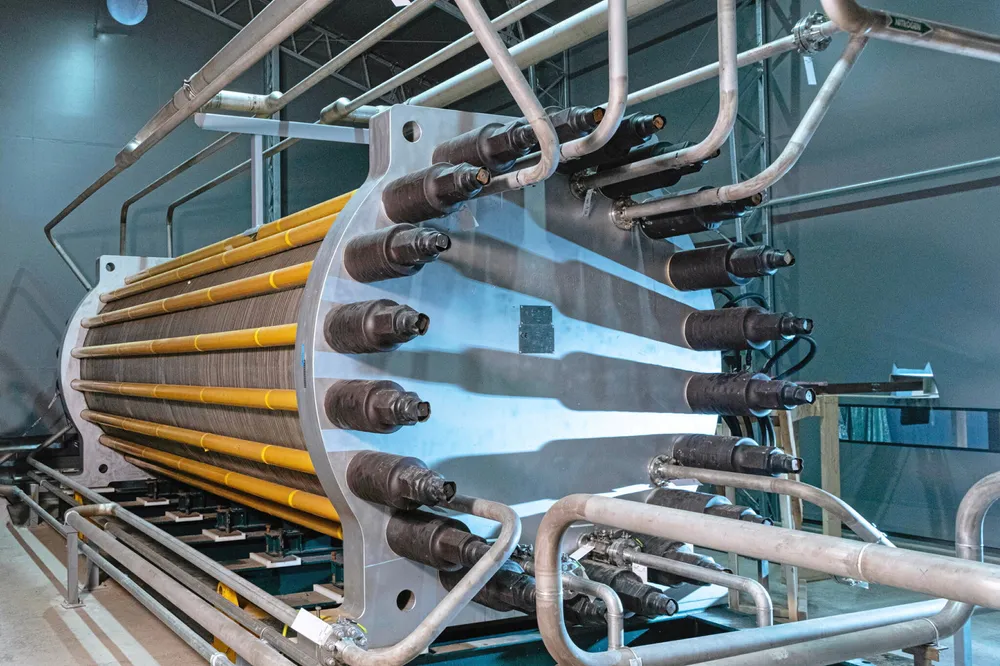

HydrogenPro puts 500MW Texas factory on hold amid clean hydrogen tax credit uncertainty

First manufacturing site outside of China delayed, as electrolyser manufacturer prepares for decreased production at Tianjin factory

First manufacturing site outside of China delayed, as electrolyser manufacturer prepares for decreased production at Tianjin factory