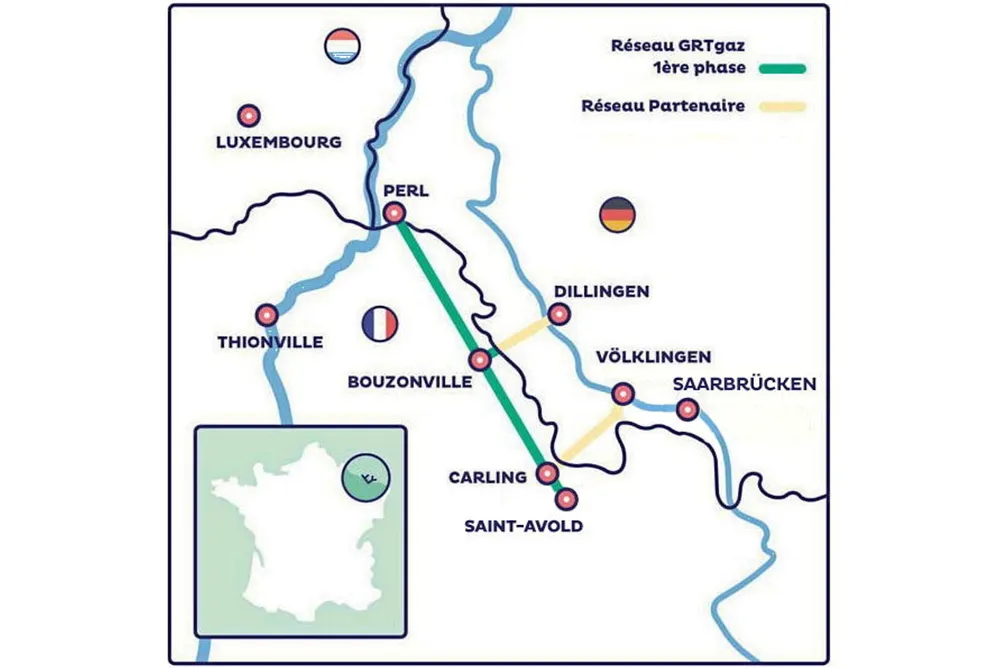

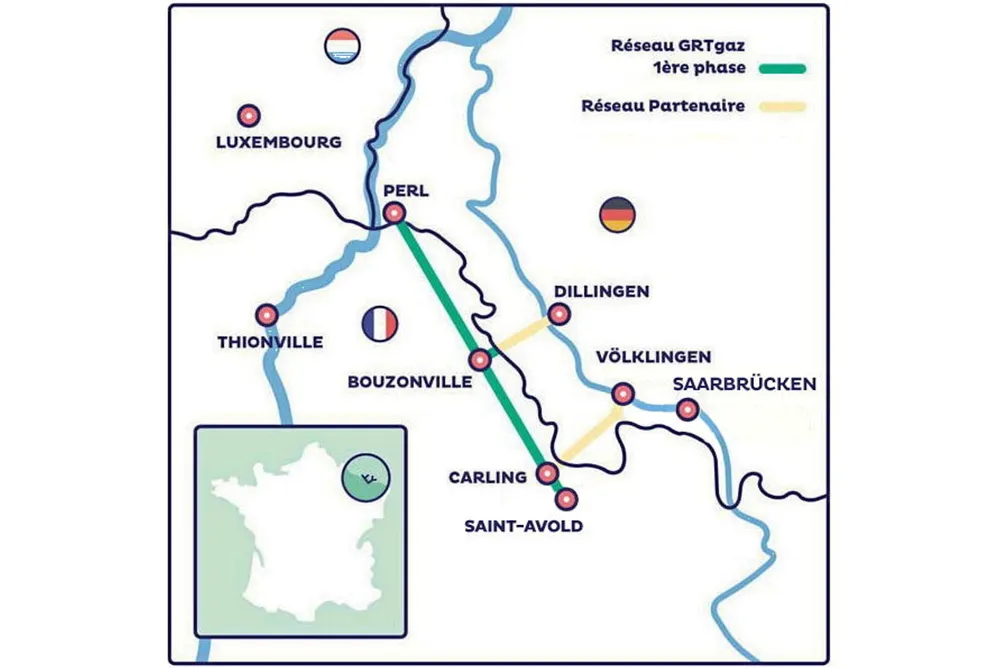

'Final investment decision' taken on €110m Franco-German hydrogen pipeline project MosaHYc

French part of network has reached FID, but German partner says its FID depends on state funding from government

French part of network has reached FID, but German partner says its FID depends on state funding from government