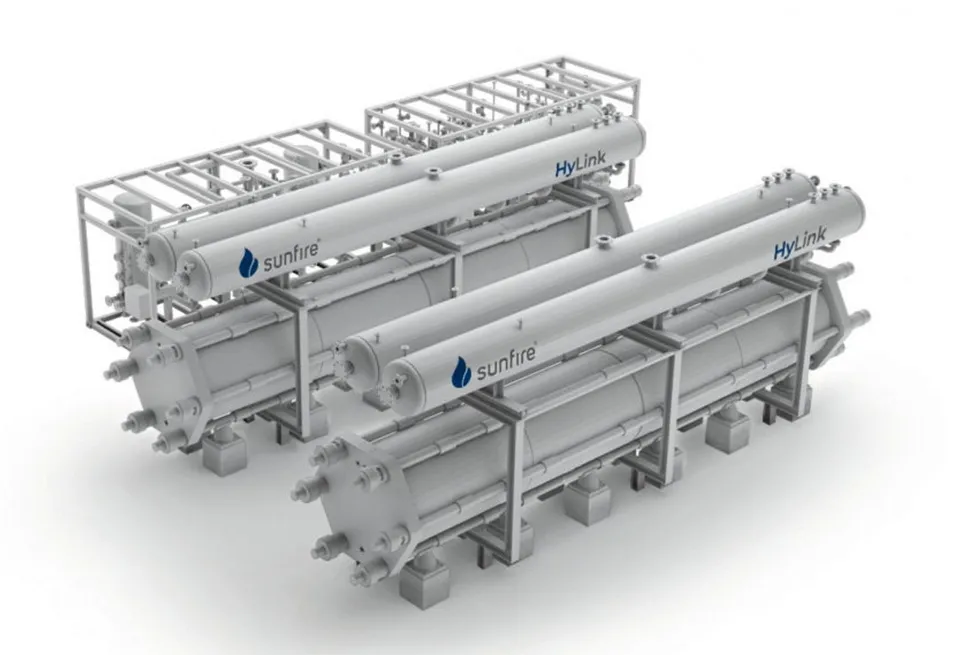

German hydrogen electrolyser maker Sunfire 'could soon be valued at more than €1bn': report

Solid-oxide specialist in negotiations with investors over €200m financing round, according to business daily Handelsblatt

Solid-oxide specialist in negotiations with investors over €200m financing round, according to business daily Handelsblatt