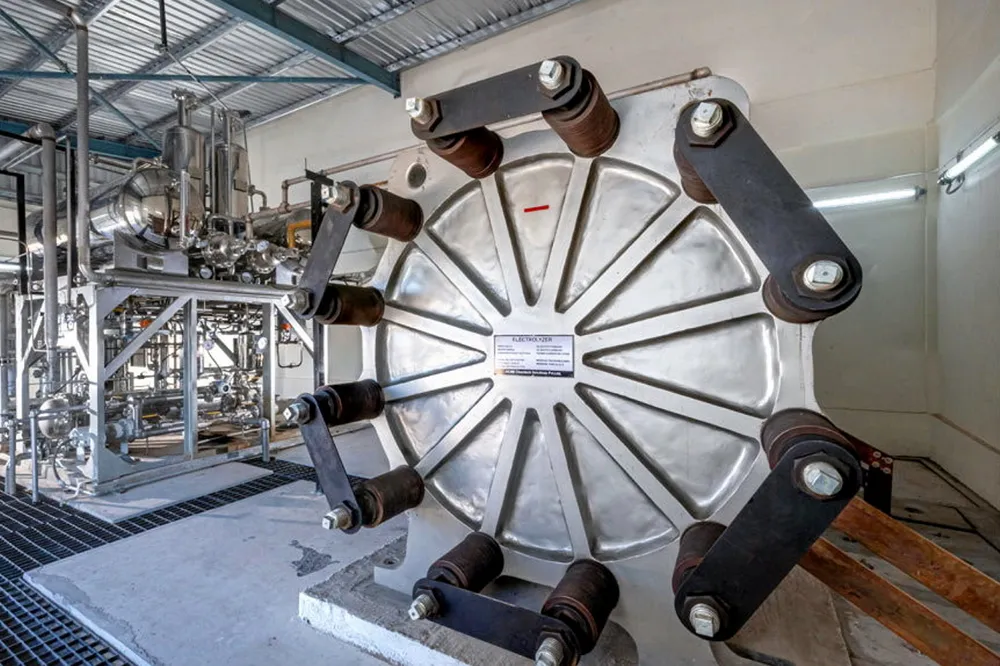

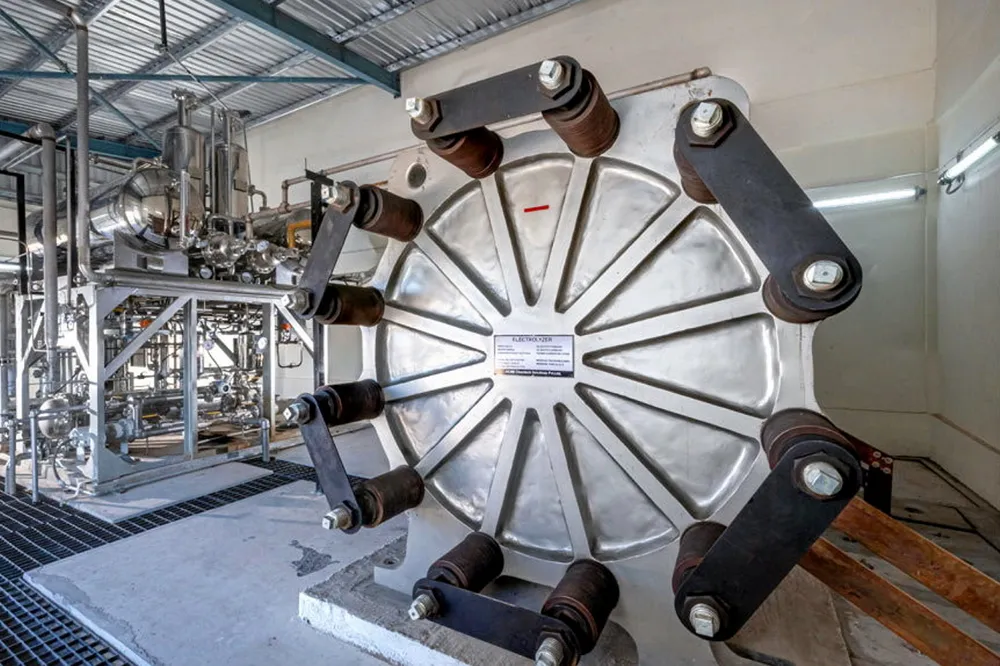

India announces bidders for country's first green hydrogen and electrolyser manufacturing subsidies

The two tenders have been oversubscribed, with three companies bidding the maximum for both

The two tenders have been oversubscribed, with three companies bidding the maximum for both