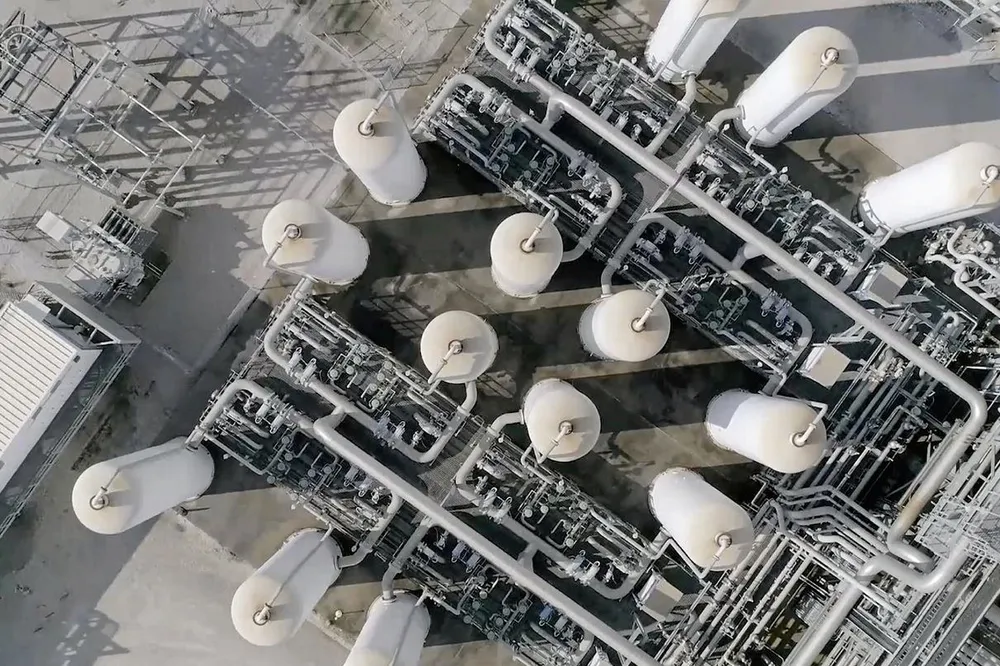

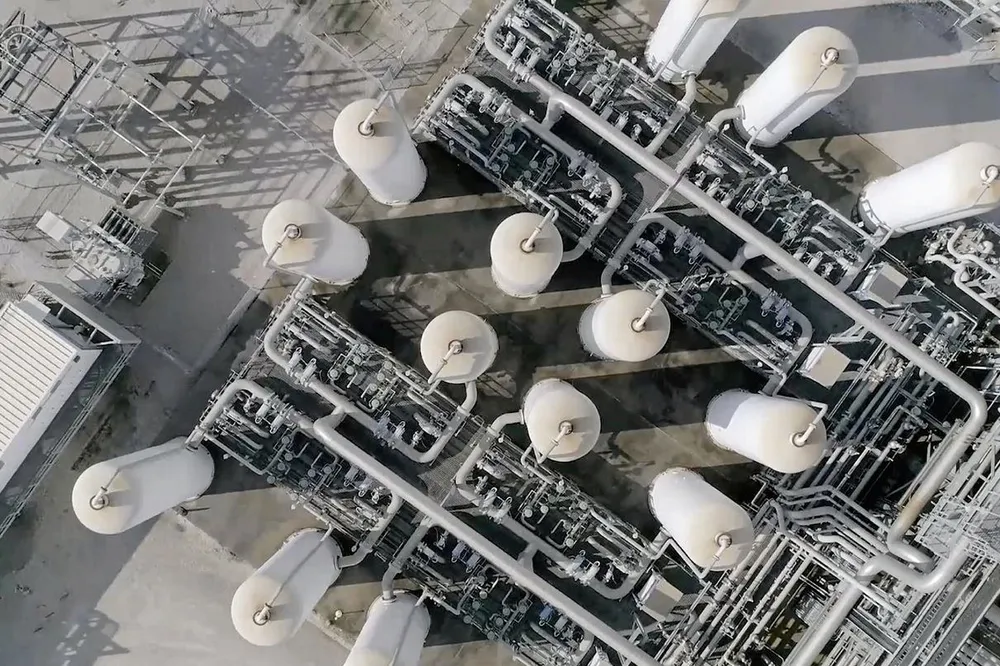

Blue hydrogen unlikely to qualify for US H2 tax credits due to high upstream emissions: Department of Energy

Both SMR and ATR with CCS have lifecycle emissions and costs above what the US is targeting for clean H2

Both SMR and ATR with CCS have lifecycle emissions and costs above what the US is targeting for clean H2