Green hydrogen imported to Europe would be cost-competitive with locally produced H2 by 2030: analyst

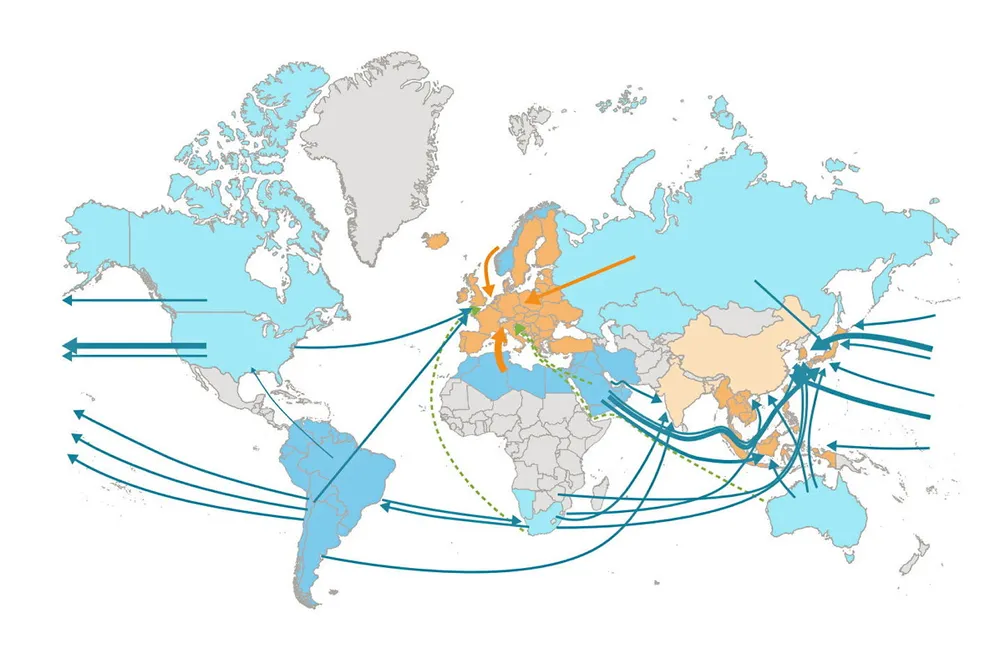

Imports from Morocco, Australia and Chile would be economically attractive, with hydrogen from Spain being the cheapest option for Germany, says Aurora Energy Research