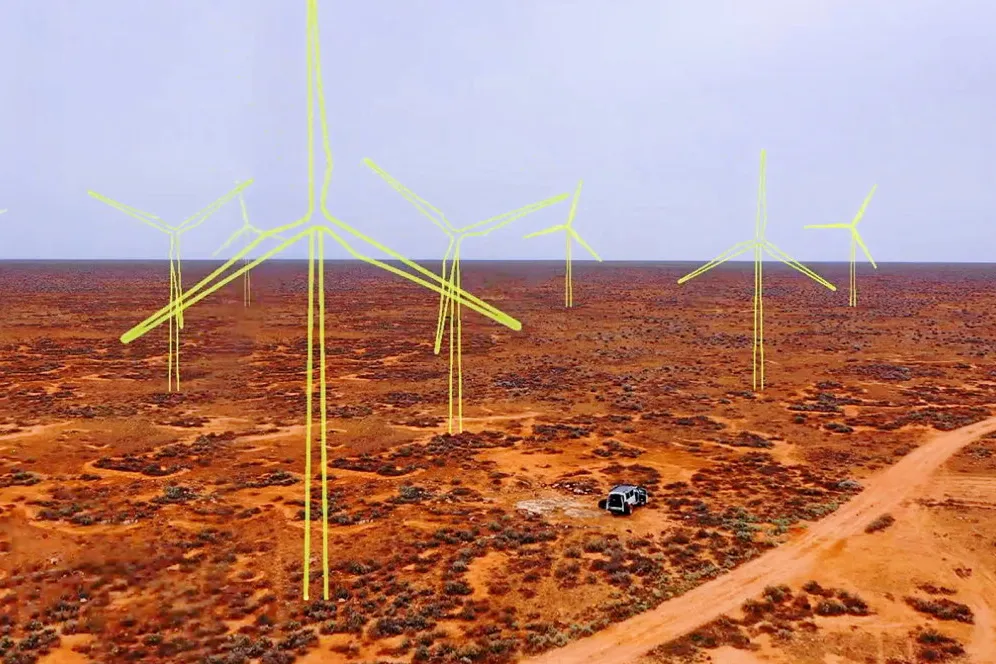

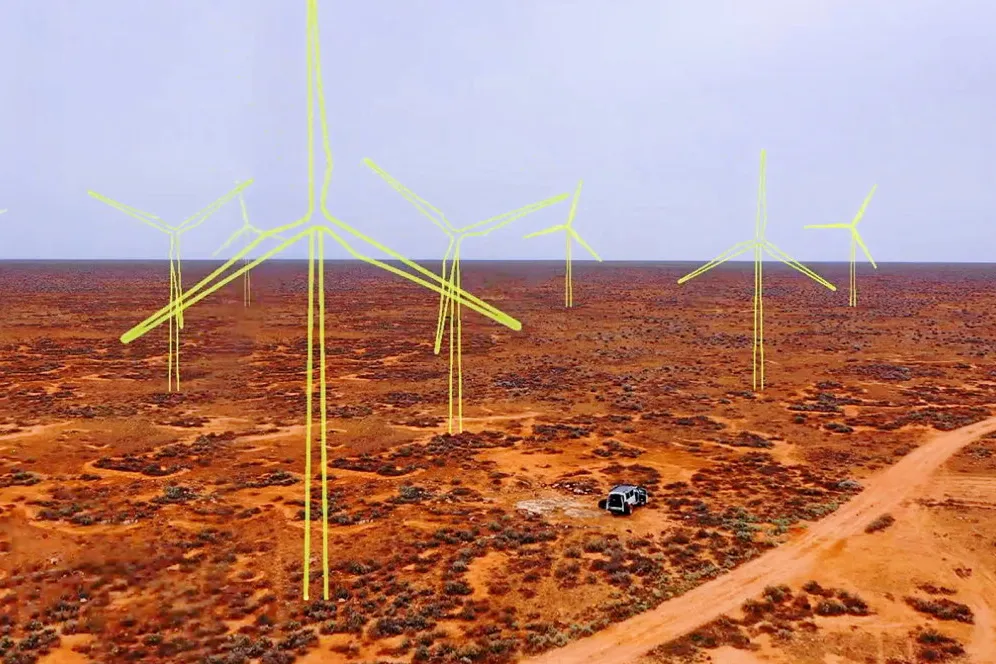

Impossible dreams? The 11 biggest green hydrogen projects announced around the world so far

If fully built out, these facilities alone would provide more than 100 million tonnes a year, about a third of the amount the planet may require by 2050

If fully built out, these facilities alone would provide more than 100 million tonnes a year, about a third of the amount the planet may require by 2050