Mystery developer announces plan to spend over $3bn on blue-hydrogen-to-methanol plant

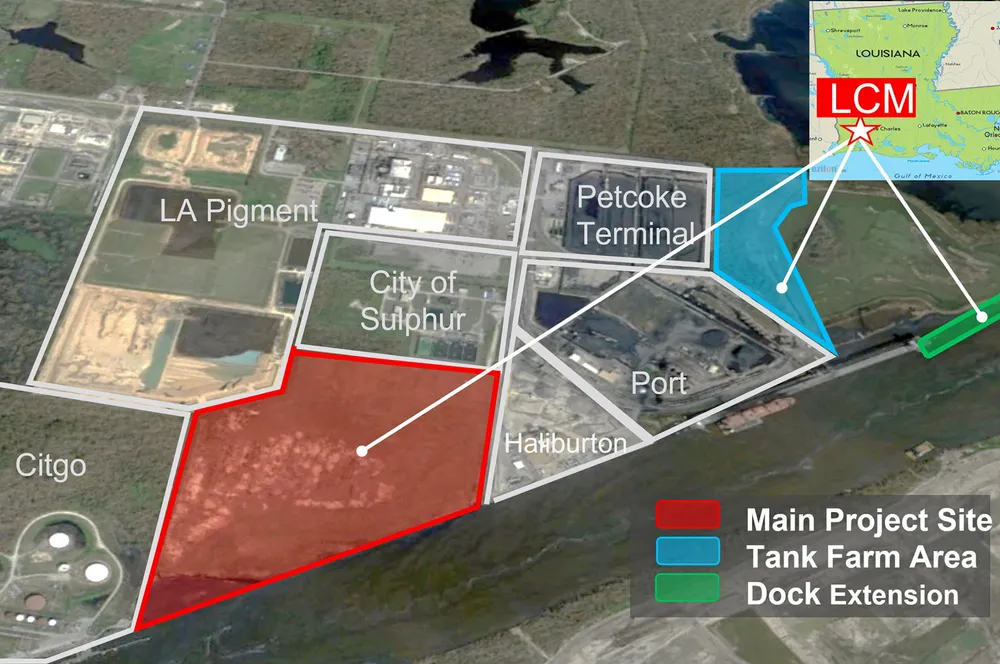

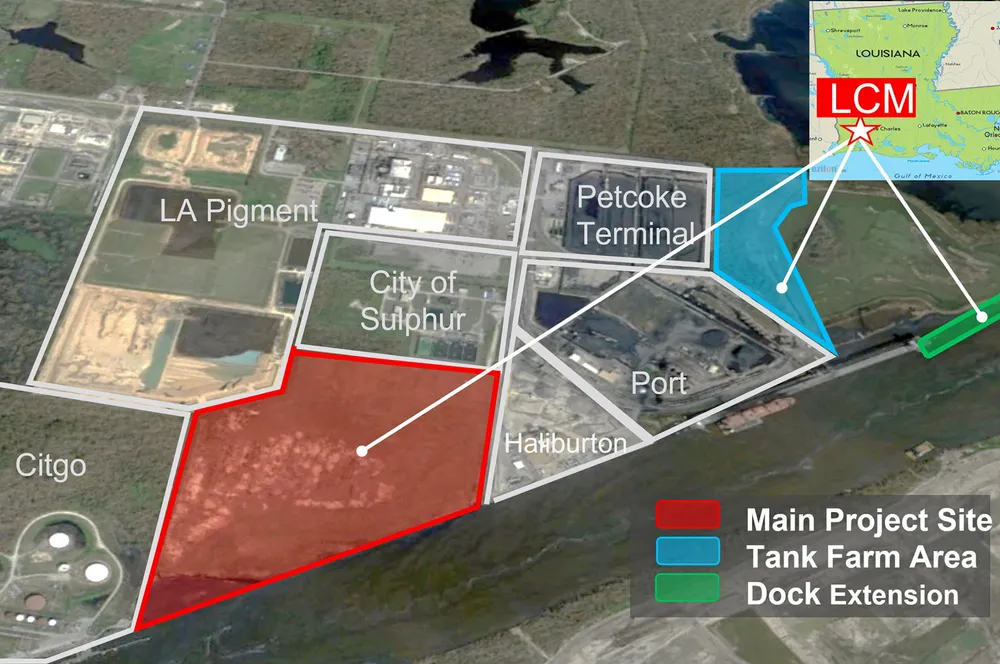

Revamped proposal for Lake Charles Methanol plant aims for 500,000 tonnes of low-carbon H2 per year from methane

Revamped proposal for Lake Charles Methanol plant aims for 500,000 tonnes of low-carbon H2 per year from methane